The world of cryptocurrency is rapidly evolving, bringing exciting opportunities for buying, selling and trading digital assets. While centralized exchanges (CEX) and decentralized exchanges (DEX) have long been popular for crypto swaps and trading digital assets, a new option has emerged that is revolutionizing the game – the crypto aggregator.

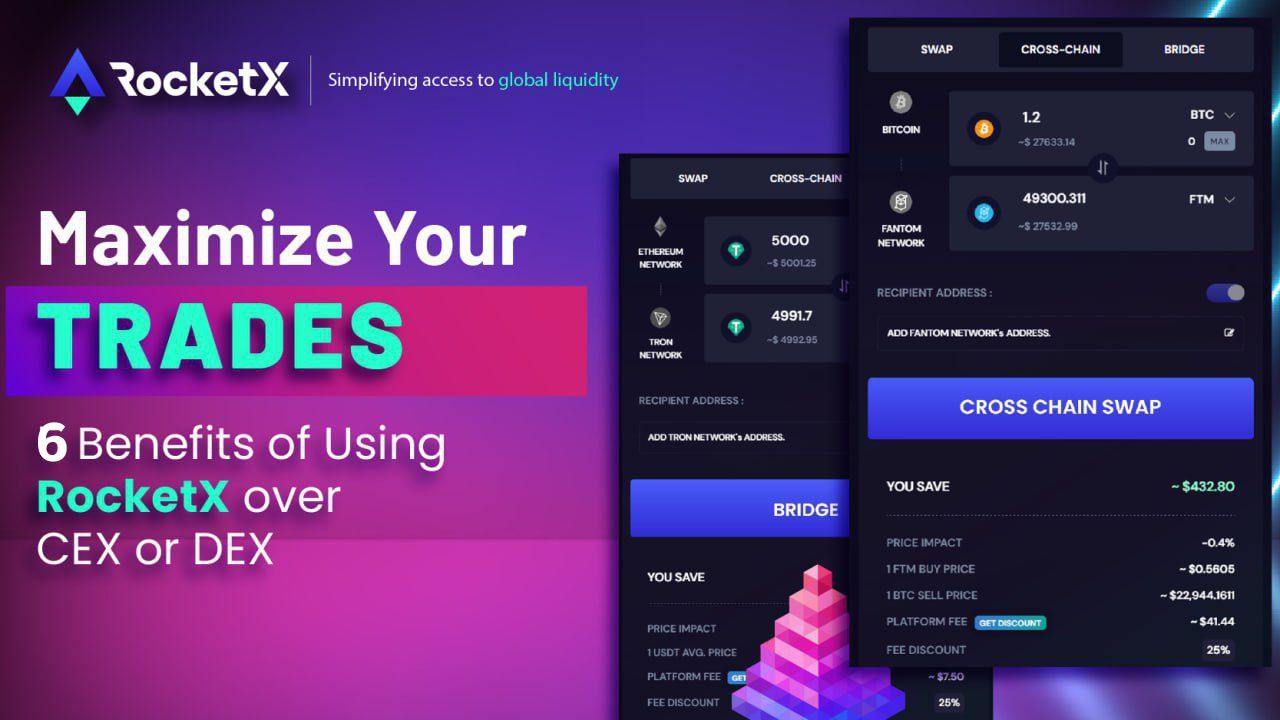

A crypto aggregator, such as RocketX, functions as a one-stop-shop for all your cryptocurrency trading needs. It integrates multiple exchanges into one platform, allowing users to access a wider pool of assets and greater liquidity. From seamless interoperability, increased liquidity and better price discovery to improved user experience and enhanced security, the benefits of using a crypto aggregator are numerous and impactful.

In this blog, we’ll explore six advantages of RocketX over a standalone DEX or CEX.

Advantages of RocketX Over DEXs and CEXs

1. Increased Liquidity

What is Liquidity in Crypto Market?

Liquidity refers to the ability of an asset to be bought or sold quickly and at a stable price. In the context of cryptocurrency exchanges, liquidity refers to the amount of a certain asset that is readily available for trading at a stable price on the platform.

Liquidity Issue on Centralized Exchanges

CEXs offer robust trading options for top cryptocurrencies like BTC or ETH, but may struggle with low liquidity in niche markets or for lesser-known assets. This results from a shortage of buyers and sellers, causing low trade volume and wider bid-ask spreads, especially on cross-chain crypto swaps.

Liquidity Issue on Decentralized Exchanges

Decentralized exchanges (DEXs) can also face liquidity issues, as the number of users and volume of trades on DEXs is often lower compared to centralized exchanges. The liquidity issue in DEXs can be exacerbated by their decentralized nature, as they often rely on users providing liquidity through their own assets. This can result in limited trading options and larger spreads between bid and ask prices for certain assets, making it difficult for users to quickly execute trades at favorable prices.

Solution

One of the primary advantages of RocketX is it provides an ideal solution to the liquidity issues faced by both centralized and decentralized exchanges. By aggregating liquidity from multiple sources and platforms, RocketX ensures that users have access to deeper and more diverse pools of liquidity to quickly swap crypto. This helps users to execute cross-chain swaps quickly and at more favorable prices through the use of its built-in cross-chain bridge.

2. Better Price Discovery

What Is Price Discovery in Crypto Exchanges?

Price discovery refers to the process by which the market determines the value of an asset. In the context of cryptocurrency exchanges, price discovery occurs when buyers and sellers transact with each other, leading to the formation of a market price.

Price Discovery Issue in Centralized Exchanges

In a CEX, the price of an asset is determined by the exchange, which may not always reflect the true market conditions. This can lead to the CEX having different prices for the same asset compared to other exchanges, which can result in users not getting the best price for their crypto swaps. In some cases, CEXs may also have conflicts of interest, such as insider trading or market manipulation, which can further impact price discovery.

Price Discovery Issue in Decentralized Exchanges

DEXs can face issues with price discovery as they are typically built on decentralized networks, which means that they rely on a dispersed network of nodes to match orders and execute cross-chain swaps. This can lead to discrepancies in prices across different nodes and make it difficult for users to determine the true market price for an asset. These challenges with price discovery can make it difficult for users to make informed investment decisions and trade effectively in the crypto market.

Solution

By aggregating liquidity from multiple decentralized and centralized exchanges, RocketX is able to offer its users a wider range of pricing options compared to a standalone DEX or CEX. This helps ensure that users receive the best possible price for their crypto swaps, regardless of the asset they are trading, and through the use of its built-in cross-chain bridge, it enables quick and efficient cross-chain swaps. In addition, RocketX’s algorithms constantly monitor and analyze pricing data from different exchanges to identify the most favorable prices. With this, RocketX provides its users with a competitive edge in price discovery, compared to using a standalone DEX or CEX.

3. Improved User Experience

What Is User Experience?

User experience refers to the overall satisfaction and perception of the end-user while interacting with a product or platform. In the context of cryptocurrency exchanges, user experience includes factors such as ease of use, navigation, and access to information.

User Experience Issue in CEXs and DEXs

Both DEXs and CEXs can have user experience issues that can make it challenging for users to swap crypto smoothly and efficiently. DEXs are known for their lack of user-friendly interfaces and complicated navigation, making it difficult for inexperienced users to do cross-chain swaps effectively. On the other hand, CEXs can suffer from slow load times, technical errors, and a lack of customization options, resulting in a subpar experience for users. These user experience issues can cause frustration and hinder the growth of the crypto market.

Solution

Another advantage of RocketX is it can offer a solution by combining the best of both worlds, providing a unified platform that offers the benefits of both DEXs and CEXs while minimizing their drawbacks. With a user-friendly interface and customizable trading options, RocketX offers an improved user experience that is designed to meet the needs of a wide range of users. On the other hand, RocketX has received positive feedback from users regarding its user-centered design, intuitive navigation, and easy access to information from multiple exchanges.

4. Lower Latency

What Is Low Latency in Crypto Exchanges?

Latency refers to the time delay between a user’s request and the platform’s response. In the context of cryptocurrency exchanges, latency is a crucial factor in determining the speed and efficiency of transactions.

Latency Issue in Centralized Exchanges

Centralized exchanges (CEX) can face latency issues due to the centralized nature of their operations. CEXs are often run on servers that are housed in a single location, which can make them vulnerable to network congestion and slowdowns. In addition, high traffic times can put pressure on CEX servers, leading to slow response times, delays in order, execution of crypto swaps, and other issues that can negatively impact the user experience. Furthermore, the centralization of the platform means that a single point of failure can bring the entire system down, causing significant latency issues and a poor user experience.

Latency Issue in Decentralized Exchanges

Decentralized exchanges (DEXs) rely on a decentralized network of nodes to execute trades, which can lead to longer processing times and higher latency. This can result in slower response times and a less fluid trading experience for users. Additionally, since DEXs use blockchain technology to settle trades, the speed of transactions can be impacted by network congestion and other technical issues. These latency issues can make it challenging for users to execute trades in real-time and can result in a less seamless trading experience.

Solution

A DEX and CEX aggregator like RocketX can solve the latency issue by integrating multiple decentralized and centralized exchanges into one platform. This helps to reduce the time required for cross-chain swap or trade execution, as users can compare prices and trade on multiple exchanges through a single platform. This can result in faster trade execution and reduced latency compared to standalone DEX or CEX platforms. Additionally, RocketX uses advanced technology and optimized infrastructure to ensure smooth and fast trade execution. By combining the best of both worlds, DEX and CEX, RocketX provides users with a seamless trading experience that is fast, secure, and efficient.

5. Enhanced Security on Crypto Swaps

What Is It?

Security refers to the measures taken to protect users’ assets and personal information. In the context of cryptocurrency exchanges, security is of utmost importance to prevent the theft or loss of assets during crypto swaps.

Security Issue in Centralized Exchanges

Centralized exchanges (CEX) can be vulnerable to various security issues, such as hacking, phishing attacks, and theft of user funds. As CEXs hold users’ funds on centralized servers, they are susceptible to hacking attempts, and a successful attack could result in the loss of user funds. Additionally, CEXs have faced several incidents in the past where hackers have stolen users’ cryptocurrencies or personal information. The centralized nature of CEXs also means that they have access to users’ private keys, making it easier for them to manipulate the users’ assets.

Security Issue in Decentralized Exchanges

One of the key security risks for DEXs is the potential for smart contract exploits. As DEXs operate through smart contracts, a vulnerability in the code of the smart contract can lead to the loss of assets.

Solution

RocketX, as a decentralized DEX and CEX aggregator, addresses the security concerns of both centralized and decentralized exchanges. By offering a decentralized platform for swapping or trading cryptocurrencies, it eliminates the risk of central point of failure, making it less susceptible to hacking attacks and theft of user funds. In addition, RocketX undergoes regular audits to ensure its smart contracts are safe to use, making it a secure option for traders looking to transact with cryptocurrencies in a decentralized fashion. The combination of a decentralized platform and regular security audits makes RocketX a safe and secure option for traders looking to transact with cryptocurrencies.

6. Seamless Interoperability

What is Interoperability in Crypto Market?

Interoperability refers to the ability of different systems or technologies to communicate and work seamlessly with each other. In the context of the cryptocurrency ecosystem, interoperability is crucial for the efficient and effective functioning of the various blockchains and digital assets.

Interoperability Issue on CEX and DEX

In the case of DEXs, most of them are limited to trading assets within a single blockchain or a small group of compatible blockchains. This limits the potential user base and liquidity for these DEXs, and makes it harder for traders to access a diverse range of assets.

On the other hand, CEXs face interoperability challenges when it comes to integrating new digital assets. CEXs typically have to go through a lengthy and complex integration process to add new assets to their platform, which can be a barrier to entry for smaller projects. Additionally, because CEXs are centralized, there is a risk of counterparty risk and potential regulatory compliance issues.

Solution

RocketX recognizes the importance of interoperability and offers solutions that help bridge the gaps between different blockchains. Our platform facilitates the seamless transfer of digital assets between Bitcoin, Ethereum, Tron, Solana, Cosmos, and more than 20 other leading blockchains.

This interoperability allows users to enjoy the benefits of different blockchain technologies without being limited to just one, thus providing solutions that enable seamless communication and collaboration between different blockchains.

Conclusion

The crypto aggregator RocketX is more effective than standalone DEXs or CEXs in the cryptocurrency exchange market due to its seamless interoperability, increased liquidity, better price discovery, improved user experience, lower latency, and enhanced security.

For those seeking a more efficient and secure platform for trading, RocketX is a highly recommended option. It is crucial to always perform thorough research and due diligence before investing in any platform, and to stay informed about the rapidly evolving cryptocurrency market.

To read more such articles, visit our Blog page or follow our social channels: