Introduction

Blockchain technology is evolving fast, and with it, new innovations are reshaping how decentralized finance (DeFi) operates. One such game-changer is Berachain, a next-generation Layer 1 blockchain that is fully Ethereum-compatible and built to maximize liquidity incentives and network security. If you’re curious about what makes this blockchain unique, how it works, and whether BERA token is worth considering, you’re in the right place.

In this guide, we’ll break down what Berachain is, how it works, its ecosystem, and everything you need to know about BERA tokens. We’ll also walk you through how to bridge assets to this new chain using RocketX Exchange so you can get started easily.

What is Berachain?

Berachain is a high-performance blockchain designed to offer a seamless experience for developers and users looking for a more efficient and liquidity-driven network. What sets it apart is its unique Proof-of-Liquidity (PoL) consensus model, which ensures that validators are actively contributing liquidity while securing the network.

Founded by Dev Bear, Man Bera, Smokey The Bera, and Papa Bear, Berachain started as an NFT project before evolving into a full-fledged Layer 1 blockchain. The founders, who were early participants in DeFi, designed Berachain to tackle liquidity fragmentation while maintaining a strong security model.

Unlike traditional blockchains that rely on Proof-of-Stake (PoS) or Proof-of-Work (PoW), Berachain’s PoL model incentivizes validators, liquidity providers, and developers, ensuring that the chain remains economically sustainable and scalable.

How It Works

Berachain is fully EVM-compatible, meaning it functions just like Ethereum. Developers can easily deploy smart contracts and decentralized applications (dApps) without modifying their existing codebases. However, what truly makes it stand out is its consensus and tokenomics model.

Proof-of-Liquidity (PoL): A New Consensus Model: Traditional blockchains require validators to stake tokens to secure the network. Berachain changes this by requiring validators to provide liquidity instead. Validators stake BERA tokens and, in return, receive Berachain Governance Tokens (BGT), which can be used for governance decisions and further staking. This ensures that liquidity remains active and beneficial to the ecosystem, rather than being locked away in staking contracts.

BeaconKit & Modular Framework: Berachain uses BeaconKit, a modular framework that enhances network composability and allows for quick upgrades. It also integrates CometBFT consensus, which ensures faster finality and improved security compared to older blockchain models.

Node Infrastructure: Validators and RPC nodes on Berachain can be configured as full nodes or archive nodes, making it easier to support large-scale dApps, NFTs, and DeFi applications. This flexibility ensures that developers have access to scalable infrastructure without compromising speed or security.

Exploring the Berachain Ecosystem

Berachain isn’t just a blockchain—it’s an entire ecosystem designed to support DeFi, NFTs, and cross-chain interoperability. Some of its key features include:

- BEX (Berachain Exchange) – A decentralized exchange (DEX) for swapping and trading crypto assets.

- Bend – A non-custodial lending protocol that allows users to borrow and lend digital assets.

- Berps – A decentralized leveraged trading platform for margin traders.

- Beratrail – Berachain’s block explorer, allowing users to verify transactions and contracts easily.

- Cross-chain Compatibility – Berachain integrates with multiple blockchains, allowing seamless asset transfers and liquidity sharing.

With these features, Berachain aims to be a one-stop solution for developers and traders looking to build and participate in the next generation of decentralized finance.

BERA Token: What You Need to Know

BERA is the native utility token of Berachain, playing a crucial role in network security, governance, and transaction processing. As the primary gas token, BERA facilitates all transactions on the network, ensuring smooth operations for decentralized applications and smart contracts.

One of the key uses of BERA is validator staking. Validators must stake BERA tokens to participate in securing the network and, in return, earn Berachain Governance Tokens (BGT) as rewards. This unique mechanism promotes capital efficiency while maintaining the security and decentralization of the network.

In addition to securing the network, BERA also plays a role in liquidity incentives. Users who provide liquidity to Berachain’s ecosystem are rewarded with BERA tokens, encouraging a sustainable and well-balanced economic model. Furthermore, BERA holders can engage in governance activities by converting their tokens into BGT, allowing them to participate in network decisions and protocol updates.

BERA Tokenomics

The total supply of BERA is 500 million tokens, with 48.9% allocated to community-driven initiatives aimed at fostering ecosystem growth. Berachain’s emission model ensures a controlled and sustainable token economy by allowing BGT to be burned 1:1 for BERA, helping regulate supply and maintain economic stability.

With its strong use cases and innovative tokenomics model, BERA is designed to sustain long-term network growth, liquidity engagement, and governance participation.

Should You Buy BERA? Future Potential

BERA has strong fundamentals, and with Berachain’s innovative Proof-of-Liquidity model, it has the potential to disrupt traditional DeFi staking models. The project is still in its early stages, but its liquidity-first approach and governance incentives make it a compelling option for long-term investors.

However, as with any crypto investment, it’s essential to DYOR (Do Your Own Research) and consider market volatility before investing.

How to Buy BERA or Bridge to Berachain Using RocketX

If you’re looking to buy BERA tokens or bridge assets to Berachain, RocketX Exchange offers a seamless and efficient process. Follow these simple steps to get started:

- Go to RocketX Exchange – Open your browser and visit the official RocketX Exchange website.

- Connect Your Wallet – Click on “Connect Wallet” and choose a wallet based on the blockchain you are using. If you’re on an EVM-compatible blockchain, select MetaMask, OKX, or Rabby Wallet. For Solana, use Phantom or Backpack Wallet. If you’re using Sui, opt for Suiet or SafePal. Similarly, for other blockchains, select their native wallets to ensure seamless connectivity.

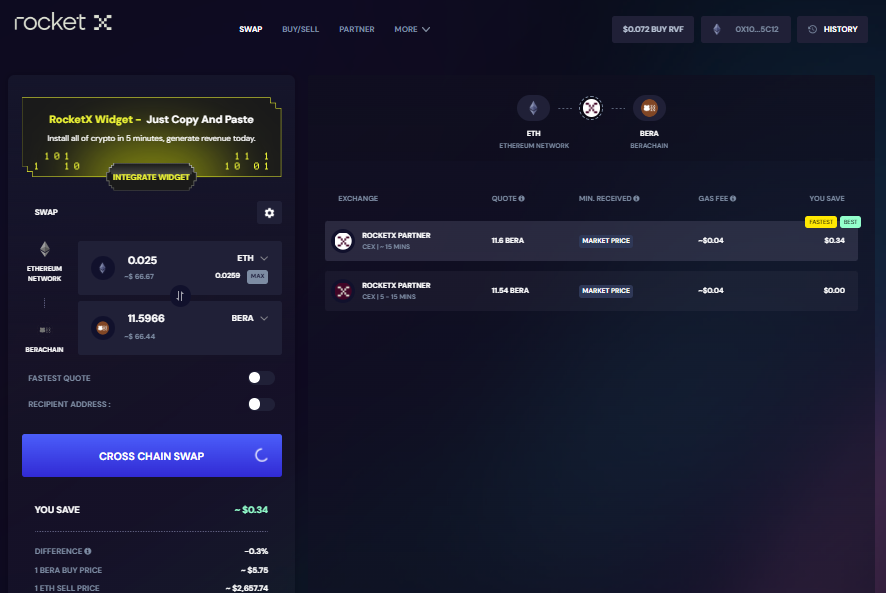

- Select the Source & Destination Networks and Tokens – Choose the blockchain you are swapping from, such as Ethereum, BNB Chain, or Polygon, and set Berachain as the destination. In this guide, we are using Ethereum as the source blockchain and ETH as the source token.

- Enter Swap Amount – Input the amount of crypto you want to exchange for BERA tokens.

- Review & Confirm the Transaction – Check the estimated swap rate, network fees, and the number of BERA tokens you will receive.

- Approve & Complete the Swap – Once you’ve reviewed all the details, click on “Cross Chain Swap” and approve the transaction in your connected wallet.

- Receive Your BERA Tokens – Once the transaction is complete, your BERA tokens will be credited to your wallet.

With RocketX Exchange, you can swap and bridge assets seamlessly, ensuring you get the best rates with minimal slippage across multiple blockchains.

What to Do After Buying BERA Tokens?

After purchasing BERA tokens, the next step is to maximize their potential within the Berachain ecosystem. Whether you want to stake, provide liquidity, trade, or participate in governance, there are multiple ways to put your tokens to good use.

One of the best options is staking BERA, which allows you to earn rewards while helping secure the network. Through Berachain’s Proof-of-Liquidity (PoL) model, validators stake BERA to receive BGT rewards, which can be further used for governance or burned for additional BERA tokens.

Another way to earn passive income is by providing liquidity on BEX (Berachain Exchange) or Bend (a lending platform). Liquidity providers receive trading fees and incentives, making it a great way to grow your holdings over time.

If you’re interested in governance, you can convert BERA to BGT and participate in voting on important network proposals. This ensures that holders have a say in Berachain’s future development.

Conclusion

Berachain is revolutionizing blockchain technology with its Proof-of-Liquidity model, EVM compatibility, and liquidity-driven DeFi ecosystem. With strong community support, governance incentives, and cross-chain integrations, Berachain is positioned to become a major player in the DeFi landscape.

For those interested in buying BERA or bridging assets, RocketX Exchange offers the most efficient and cost-effective solution.

Trade smarter with RocketX—your gateway to seamless crypto swaps across multiple blockchains. 🚀