Introduction

As the demand for decentralized, scalable, and yield-generating stable assets rises across DeFi, CeFi, and TradFi, Ethena Finance has emerged as one of the most innovative protocols in the crypto ecosystem. It has redefined what a stablecoin can be through its delta-neutral, crypto-native synthetic dollar: USDe.

This article walks you through everything you need to know about Ethena, Ethena Labs, the role of its synthetic dollar USDe, how it maintains stability, the rewards mechanics of sUSDe, and how the ENA token powers the ecosystem. Finally, we’ll guide you on how to buy Ethena (ENA) using RocketX Exchange.

What Is Ethena Finance?

Ethena Finance is a protocol built on Ethereum that issues a fully backed, crypto-native synthetic dollar called USDe and a yield-bearing variant called sUSDe. Unlike traditional stablecoins like USDT or USDC, which rely on fiat collateral and banking rails, USDe is backed by a delta-hedged combination of spot crypto assets (like BTC, ETH, SOL) and short perpetual futures contracts, along with some liquid stables.

This approach brings together the best of both centralized and decentralized finance: stability, scalability, capital efficiency, and censorship resistance.

The goal of Ethena is not just to issue another stablecoin—it aims to build the “internet bond” of the future: a synthetic dollar that generates yield while remaining composable across DeFi and secure in bear markets.

The demand for such a product is massive: over 70% of all crypto transactions today settle in stablecoins. With Ethena’s sUSDe, users now have a stable, yield-generating alternative.

How USDe Works

To understand what makes Ethena’s USDe so unique, it’s important to see how it manages to stay close to the value of $1 at all times—also known as “maintaining its peg.”

When a user wants to mint USDe, they simply deposit popular cryptocurrencies like USDT or ETH as collateral. But behind the scenes, Ethena does something clever. It opens a short position in the futures market, which means it’s betting that the price of the deposited asset might go down. This short position offsets the price movement of the original asset, so if the value of ETH or USDT changes, the change is balanced out. This method is called delta-neutral hedging, and it helps keep the value of USDe stable no matter what happens in the market.

Unlike some stablecoins that require more than 100% of the collateral to be locked up (called overcollateralization), USDe only needs 1:1 collateral—which means it’s more efficient and scalable. Plus, Ethena doesn’t take any profit from the minting or redeeming process. Its goal is to keep the system secure and sustainable.

Ethena also strengthens its setup by holding liquid stablecoins like USDC and USDT, which it can lend or farm to earn additional rewards. This not only boosts protocol revenue but also helps protect the system during tough market conditions.

What Is sUSDe? Earning Yield with Ethena

Think of USDe as your digital dollar in the crypto world and sUSDe as your savings account that earns interest. When you stake your USDe, it gets converted into sUSDe, which then starts earning you passive income.

The primary source of this income comes from funding payments on short-future trades that Ethena manages in the background. In 2024, users who held sUSDe earned an impressive average annual yield of 18%—much higher than most other stablecoin strategies out there.

sUSDe also benefits from a few other income sources, such as:

- Earnings from stablecoins like USDC and USDT held by the protocol.

- Returns from lending or integration with centralized finance (CeFi) platforms.

And the best part? As more DeFi apps like Ethereal and Derive start using sUSDe, its value and utility will only grow. That means even more ways to earn and use your staked assets across the ecosystem.

Ethena Network: Building a New On-Chain Economy with sUSDe

Ethena is evolving from a single protocol into a full ecosystem with the launch of the Ethena Network—a platform designed to power new DeFi applications using sUSDe, its yield-generating synthetic dollar. The goal is to establish a new on-chain economy where sUSDe becomes the default unit of account, replacing return-free stablecoins like USDC and USDT.

Two flagship projects already launched on the Ethena Network include:

- Ethereal – A perpetual and spot trading platform built as its own appchain. Ethereal uses sUSDe for settlement and rewards and benefits directly from Ethena’s liquidity and hedging infrastructure.

- Derive – One of the largest on-chain options and structured product platforms, integrating sUSDe as a core collateral asset.

Beyond these, several top DeFi and CeFi platforms are adopting USDe and sUSDe:

- Deribit and Hyperliquid plan to support USDe as collateral.

- On BNB Chain, protocols like Venus, PancakeSwap, and Pendle now support Ethena’s assets.

This growing network is aligned through sENA, the staked version of ENA, which accrues value through rewards, airdrops, and governance rights. For example, Ethereal has committed 15% of its token supply to sENA holders.

As more projects adopt sUSDe, Ethena is creating a dynamic financial layer for DeFi—one that is scalable, composable, and reward-driven, reshaping how stable assets work across crypto.

Everything You Need to Know About the ENA Token

The ENA token is the heart of the Ethena ecosystem. It isn’t just a digital asset—it helps run the platform, secure the network, and reward those who support it. Whether you’re a casual user or a dedicated builder, understanding ENA’s role gives you a clearer view of how Ethena is redefining on-chain finance.

ENA for Governance: Your Voice in Ethena’s Future

Holding ENA gives you voting power. This means you can directly participate in important decisions about Ethena’s future. For example, ENA holders have voted to include new backing assets like SOL, decide where the protocol’s treasury (like funds in BlackRock’s BUIDL token) should be allocated, and even approve ecosystem expansions like adding Ethereal, a new decentralized exchange.

By participating in these votes, ENA holders act like governors—guiding protocol growth and ensuring it stays aligned with the broader community.

Earn Rewards by Staking ENA (sENA)

When you stake your ENA tokens, you receive sENA, a special version of the token that earns passive rewards. These rewards include leftover tokens from airdrop campaigns, 15% of the token supply from upcoming projects like Ethereal, and future tokens from other DeFi apps that will launch on Ethena.

This setup is similar to how BNB works on Binance—offering loyal supporters a share in the future growth of the network. Staking is also a signal of long-term belief in the ecosystem, and the more builders join, the more valuable sENA becomes.

Extra Use Case: Restaking ENA for Cross-Chain Security

Beyond governance and rewards, ENA also powers restaking. With help from Symbiotic, users can restake ENA to help secure cross-chain transfers of USDe (Ethena’s synthetic dollar) using LayerZero technology. This expands ENA’s utility across multiple blockchains and increases its role in securing DeFi infrastructure.

ENA Tokenomics: A Sustainable Model for Growth

The tokenomics of ENA are carefully designed to support long-term growth and ecosystem sustainability. With a total supply capped at 15 billion ENA, the allocation is thoughtfully split to balance development needs, community rewards, and investor interest. Core contributors receive 30% of the supply, subject to a 1-year cliff and a 3-year linear vesting period. This ensures that the team remains committed to the project’s success over time. Investors are allocated 25%, also under the same vesting terms, creating aligned incentives between builders and backers.

Another 30% of ENA is dedicated to ecosystem growth and airdrops, fueling incentive campaigns, liquidity programs, and partnerships with emerging applications. The remaining 15% is held by the Ethena Foundation for R&D, security audits, reserve fund management, and future protocol upgrades.

As of April 2025, around 5.55 billion ENA are in circulation. The slow, linear unlock schedule ensures price stability and avoids sudden token inflows into the market. With the majority of tokens aimed at fostering decentralized innovation, ENA’s tokenomics support a sustainable model aligned with Ethena’s long-term mission in the DeFi space.

How to Buy Ethena or USDe Using RocketX Exchange

Buying ENA or bridging into USDe is easy, fast, and cost-efficient with RocketX Exchange—a hybrid aggregator that pulls the best prices from 250+ DEXs and CEXs and supports cross-chain swaps across 180+ networks.

Here’s how you can use it:

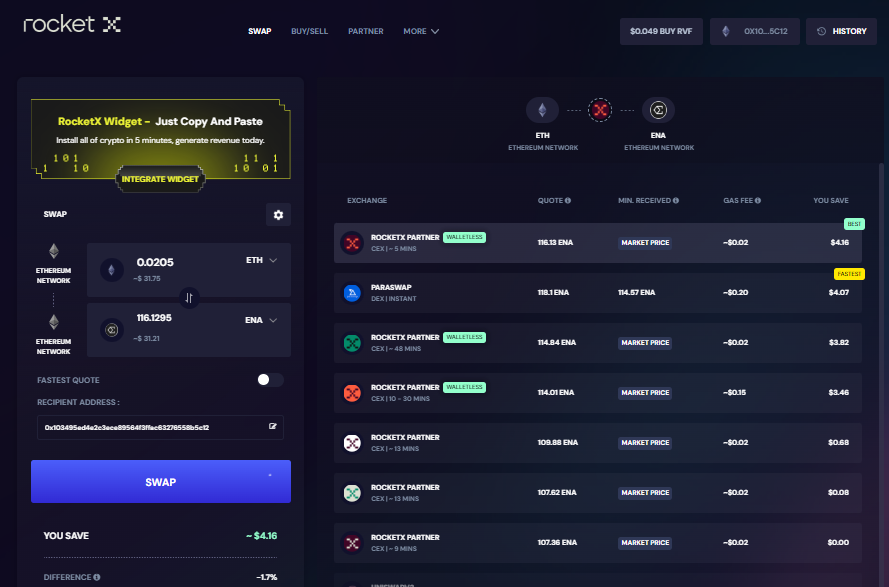

🔹 Step-by-Step Guide to Buy ENA on RocketX

- Visit RocketX Exchange

Open the swap interface directly in your browser—no installation needed. - Connect Your Wallet

Use MetaMask, WalletConnect, or any supported wallet to get started. Your wallet address will appear on the interface. - Choose Source Token

In the example, ETH is selected. You can also use USDC, BNB, or any supported asset from 180+ networks. - Select Ethena Token(ENA) or USDe as the Destination Token

For ENA, Ethereum Network is typically used. For USDe, networks like BNB or Optimism may apply.

5. RocketX Finds the Best Route Automatically

It compares real-time quotes from multiple exchanges, showing you the cheapest, fastest, or most optimal path.

6. Enter Your Recipient Wallet Address

By default, it sends to your connected wallet, but you can specify a different address if needed.

7. Click “Swap” and Confirm in Your Wallet

RocketX will automatically route the trade for you. No need to visit external bridges or exchanges.

8. Done!

Your ENA or USDe will appear in your wallet within minutes.

RocketX Exchange simplifies DeFi trading—no technical skills needed, just a smooth user experience with top-notch rates!

Future Potential of the ENA Token

The ENA token is positioned to become a cornerstone asset in the next wave of DeFi innovation. As the governance and utility token of the Ethena ecosystem, its value is directly tied to the growth of USDe adoption, sUSDe integrations, and the expansion of the Ethena Network. With major applications like Ethereal and Derive already building on sUSDe, ENA holders benefit from early-stage exposure to an emerging ecosystem. Through sENA staking, users receive rewards from future app token launches—similar to the successful BNB model. Additionally, restaked ENA is used to secure cross-chain transfers, increasing its utility across multiple blockchains. As the network attracts more protocols and traditional finance integrations, ENA’s demand and influence are expected to grow significantly. With a long-term-focused tokenomics design and increasing governance power, ENA has strong potential to become a leading asset in DeFi and crypto’s financial infrastructure.