Crypto swap exchanges let traders swap one digital asset for another without using fiat cash as an intermediary. Unlike coin trading, swapping crypto coins is seamless and quick. If you’re looking to change from coin A to coin B, you don’t have to first exit to USD and then buy coin B using the USD. The whole process is to convert one crypto coin into another coin without the need for fiat currencies.

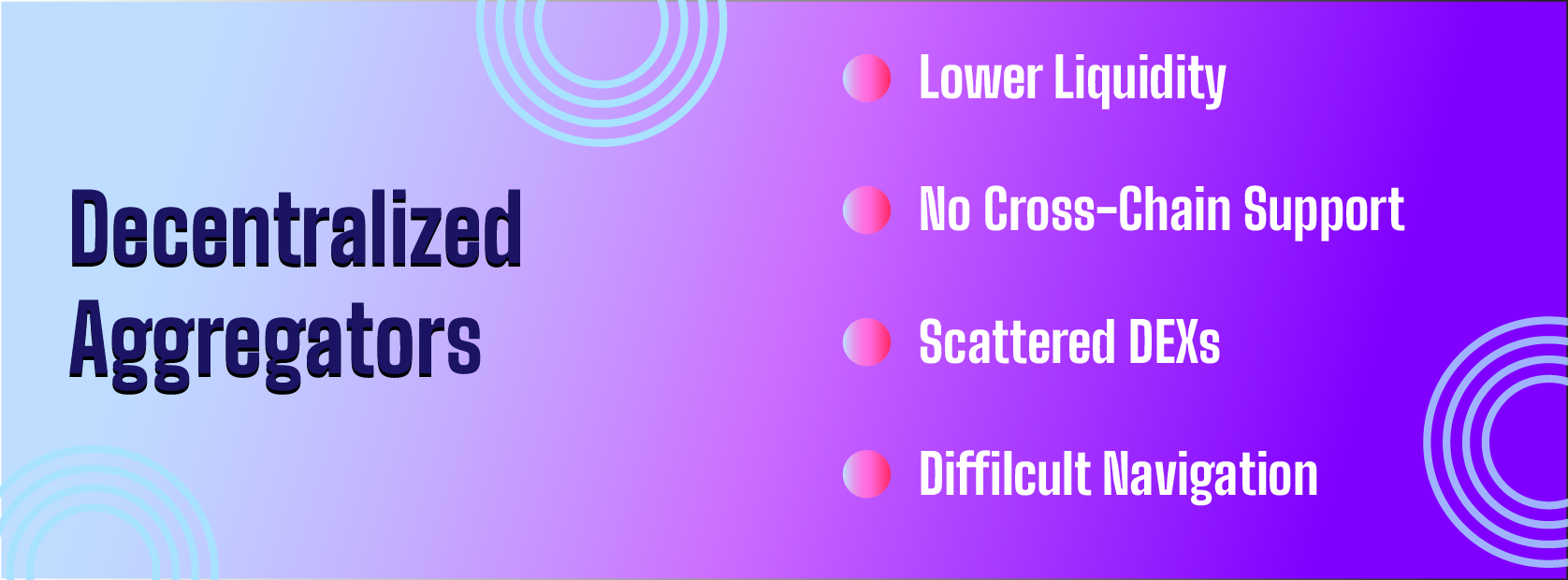

Several exchanges, especially decentralized ones, have incorporated this technology. To facilitate speedy coin-to-coin transfers, crypto swap sites typically utilizes proprietary smart-order-routing engine and smart contracts. The decentralized crypto swap platforms are popular among crypto traders since they do not need the creation of an account. However, their complicated user interface and frequent liquidity issues with DEXs, could make for a poor crypto swap experience.

Let’s look into top decentralized exchanges and their pros and cons. We will then delve into the benefits of a hybrid exchange over decentralized aggregators.

1Inch:

It is a decentralized crypto exchange aggregator or DEX aggregator. Currently, 1inch supports over 245 liquidity sources from 8 blockchains, they have over 3 million users and a volume of more than $223 Billion. At 1inch Exchange, connecting a web3 wallet and then swapping tokens at the best possible rates is a simple process.

1inch compares prices across different exchanges to discover the best deals for each swap you want to make. It might provide you better prices than many of the main exchanges, depending on the currency pair you are dealing. 1Inch might also split the swap across many exchanges, If doing so offers you a better value.

Additionally, you can create a limit order if you don’t like the pricing you see. You can enter the price you want to pay, and the transaction will only be completed if the exchange rate reaches that value.

When you trade with 1inch, you must pay the exchange fees as well as any transaction costs (gas fees). However, 1inch does not add any additional platform fees. Also, you won’t have to pay fees to withdraw or deposit your cryptocurrency because 1inch doesn’t store your assets on its servers.

ParaSwap:

It is also a decentralized exchange aggregator that provides the best prices over multiple DEXs, but tends to have lower gas fees. They get liquidity from 100+ DEXs, across 5 chains on L1 and L2, with a total volume of over 30 Billion USD. ParaSwap sources their liquidity from major DEXes such as Uniswap, Curve, Kyber, Balancer in addition to ParaSwapPool, their professional Market Maker network.

They aggregate DEXs on multiple blockchains, like Ethereum Mainnet, Binance Smart Chain, Avalanche, Polygon and Fantom. Like 1Inch, ParaSwap also splits orders across multiple exchanges into one optimized and secure transaction. When a swap is confirmed, the order is executed across exchanges. Also a free-to-use decentralized crypto exchange like 1Inch, it doesn’t charge any additional platform fees from users.

Those were the top 2 & most popular DEX aggregators for crypto swapping. However, the major con with both the above DEX aggregators is the lack of cross-chain crypto swaps. Due to this the users have to do exchange-hopping or do a series of transactions on the same exchange, incurring additional gas fees, to complete a cross-chain transaction.

This also leads to the second disadvantage, making the platform difficult for beginners in the crypto space and also burdens advanced crypto traders, who want to extensively move their crypto across different blockchains, incurring higher transaction fees. It’s here that a Hybrid Exchange fills up the gaps and enhances the DeFi experience of crypto traders.

RocketX Exchange:

RocketX is a hybrid crypto exchange, sourcing its liquidity from 250+ exchanges, both centralized and decentralized, with 15,000+ listed crypto tokens. It works like the Expedia of both centralized and decentralized exchanges, listing the asset exchange rates, instead of hotel prices, from several DEX aggregators including 1Inch and ParaSwap, along with leading CEXs like KuCoin, OKX, etc. This provides much better liquidity than the DEX-only aggregators, optimizing swaps for users through advantageous prices, lower slippage, and limited gas fees. As mentioned earlier, this is possible because they make use of vast liquidity across CEXs and DEXs.

Users can Enjoy hassle-free cryptocurrency swaps and the best fees by comparing the most trusted crypto exchanges, including crypto exchanges directly from their DeFi wallets. So, It also doubles up as a dashboard for crypto traders to compare the rates and gas fees being offered across multiple exchanges. Both beginners and active traders will find that this can save them quite a lot of time, which is wasted in looking across the order books of multiple exchanges. RocketX is free to use when orders are routed via DEXs and they only charge industry minimum platform-fees, when orders are routed via CEX in case of better rates.

Another significant advantage of RocketX as a hybrid crypto swap exchange over DEX-only aggregators is that they offer 1-click cross-chain crypto swapping and bridging. Not only does this make the platform much easier to use for multichain transactions, but it also saves tons of transaction fees and time by eliminating the need for exchange hopping, to move crypto from one blockchain to another. Currently, they support 15 leading chains – Fantom, Solana, Avalanche, Ethereum, BNB Smart Chain, Polygon Matic, Optimism, Arbitrum and Gnonsis, making them interoperable with cross-chain transactions.

With a totally non-custodial solution that supports a variety of popular digital wallets like Coinbase, TrustWallet, MetaMask, etc, this crypto swap platform gives users total control over their digital assets. RocketX has cleared security audits from Zokyo and NII Consulting, one of the leading cyber security firms in APAC. It also has a very user-friendly interface similar to the Web2 dApps we are accustomed to. This makes using the platform and exchanging tokens even more straightforward, greatly improving users’ DeFi experiences.

Finally, we saw how DEX aggregators are a common place for crypto swaps and also discussed their shortcomings. Then we discussed how a Hybrid exchange overcomes the shortcomings of DEX Aggregators and gets crypto traders better rates from CEXs directly from their decentralized wallets.