Introduction

Injective Protocol has emerged as a transformative player in the decentralized finance (DeFi) landscape, offering a high-performance blockchain platform tailored specifically for financial applications. Founded in 2018 by Eric Chen and Albert Chon, Injective combines speed, interoperability, and advanced DeFi functionalities to enable users and developers to build next-generation financial solutions. In 2024, Injective achieved remarkable milestones, introducing innovations like iAgent 2.0 and INJ 3.0 while fostering institutional adoption through Real World Asset (RWA) tokenization. This guide delves into the Injective Protocol, its native token $INJ, how to buy and stake it, recent technological advancements, and the ecosystem’s future prospects.

What is Injective Protocol?

Injective Protocol is a high-performance blockchain platform built on the Cosmos SDK, designed to redefine financial transactions in the decentralized space. Its scalability, near-zero gas fees, and cross-chain compatibility make it a powerful solution for developers and institutions alike. With integrations spanning Ethereum, Solana, and Binance Smart Chain, Injective offers seamless interoperability, enabling users to leverage its platform for a diverse range of applications.

The platform is particularly known for its robust ecosystem of decentralized applications (dApps), including Helix DEX, Real World Asset (RWA) products, and its cutting-edge iAgent technology. By offering plug-and-play modules for developers, Injective is paving the way for new-age DeFi solutions while lowering entry barriers for institutions.

The Role of $INJ in the Ecosystem

The native token $INJ serves as the backbone of the Injective Protocol, powering various components of the ecosystem:

- Governance: $INJ holders participate in governance by voting on proposals related to upgrades, parameter changes, and ecosystem development. Proposals require $INJ deposits, which are burned if the proposal fails, reinforcing the token’s deflationary nature.

- Staking and Security: Validators and delegators stake $INJ to validate transactions and secure the network. Successful staking ensures decentralization while rewarding participants with $INJ incentives.

- Transaction Fees: $INJ is used to pay transaction fees within the ecosystem. A portion of these fees is burned, reducing the total supply over time.

- Collateral: $INJ acts as collateral in derivatives markets on Injective, enhancing its utility across the ecosystem.

The deflationary mechanism introduced with INJ 3.0 accelerates the reduction in token supply, increasing its scarcity and long-term value.

Key Advancements in 2024-2025

iAgent 2.0: Revolutionizing On-Chain AI

Injective introduced iAgent 2.0, a significant upgrade that integrates the Eliza multi-agent framework with Injective’s advanced infrastructure. This technology enables developers to deploy autonomous agents capable of executing tasks such as tokenization, yield optimization, and on-chain research.

Key features of iAgent 2.0 include:

- Parallel Agent Deployment: Developers can orchestrate multiple agents simultaneously, unlocking complex operations across ecosystems.

- Custom Integrations: iAgent supports integrations with platforms like Discord, X, and custom dApps, expanding its utility for financial services, token launches, and airdrops.

- AI Model Compatibility: iAgent works seamlessly with AI models like OpenAI, Anthropic, and Llama, broadening its appeal for innovative DeFi solutions.

INJ 3.0: Enhanced Tokenomics

INJ 3.0 introduced a dynamic supply mechanism that adjusts based on staking activity. With quarterly reductions in supply rate bounds and increased token burns, the tokenomics upgrade ensures long-term deflationary pressure.

- Deflation Rate Increase: The deflation rate has increased by 400%, supported by ecosystem growth and higher protocol revenue.

- Dynamic Burn Mechanism: A portion of dApp revenue is auctioned weekly, with the highest INJ bid burned, further reducing supply.

Price and Market Performance of $INJ

$INJ has consistently outperformed expectations, driven by its ecosystem and tokenomics. In 2024, the token reached an all-time high of $52.75, fueled by increased staking activity, ecosystem growth, and technological advancements like INJ 3.0. As of now, $INJ trades around $20, with a market cap of 2 billions.

The steady rise in staked $INJ—up from 46.6 million to 51.5 million —underscores the growing confidence in the ecosystem. Weekly burns further reduce the circulating supply, creating a positive feedback loop for price appreciation.

How to Bridge Assets to Injective Using RocketX

RocketX makes bridging assets to Injective seamless and accessible from any blockchain network. Whether you’re transferring from Ethereum, Binance Smart Chain, Solana, or others, the process is quick and user-friendly. Here’s how to bridge assets to Injective:

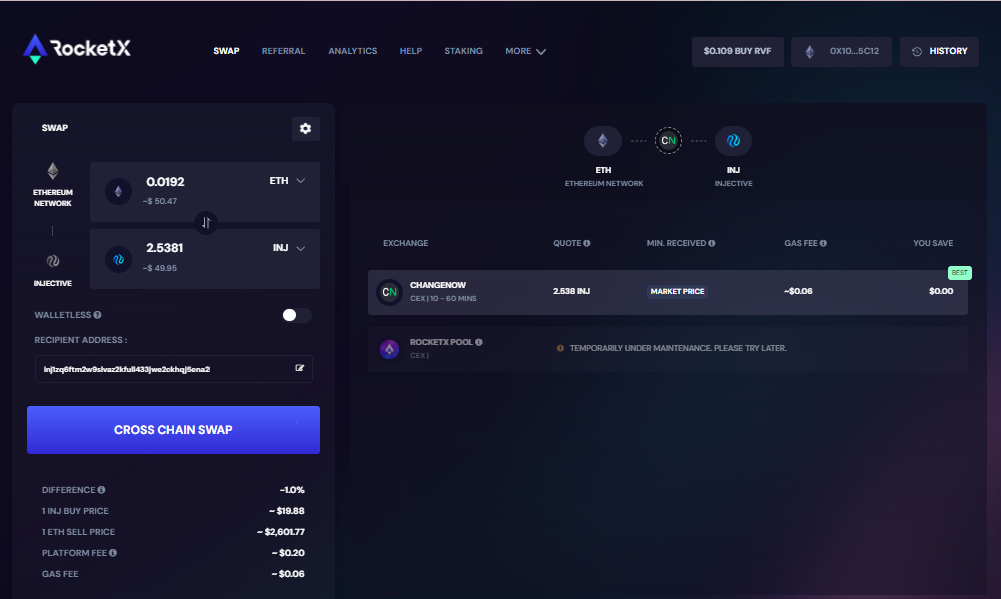

- Connect Your Wallet: Start by linking your wallet (e.g., MetaMask, Trust Wallet, or Keplr) to the RocketX platform.

- Select Networks and Tokens: Choose the source blockchain and the asset you want to transfer. For example, select Ethereum and ETH as the source. Then, select Injective as the destination blockchain.

- Enter Details: Specify the amount of tokens you wish to bridge and input your Injective wallet address. Double-check your wallet address to ensure accuracy.

- Confirm & Execute: Review all transaction details, including network fees, and click “Cross Chain Swap” to start the transfer. Now confirm the transaction in your wallet.

- Check Injective Wallet: After this process is complete, your tokens will appear in your wallet, ready for use in trading, staking, or other activities within the ecosystem.

Note: While this guide focuses on bridging assets from Ethereum to Injective, RocketX supports bridging from a wide range of networks, including BNB, Sui, Solana, Tron, and others. This flexibility allows you to easily move your assets from various blockchains into the Injective ecosystem.

How to Stake INJ

Staking INJ on Injective Hub is an excellent way to earn rewards while supporting the network’s security. Here’s a quick guide on how to stake your INJ:

- Connect Your Wallet: Start by connecting your wallet, such as Keplr, to the Injective Hub. If you don’t already have INJ, you can acquire it through RocketX Exchange.

- Access Staking Dashboard: Navigate to the staking dashboard. Here, you’ll see a list of validators.

- Choose a Validator: Select a validator you trust, delegate your INJ, and start earning rewards.

Staking is more than just a method for earning passive income—it’s a way to actively participate in the growth and security of the ecosystem. You can monitor and claim your rewards directly from your wallet and even re-delegate to different validators if you wish.

Top Wallets for Storing and Staking INJ

Choosing the right wallet is essential for managing and staking your INJ tokens. Injective supports a variety of wallets, allowing users to store and stake their tokens securely. Here are five top wallets for managing and staking INJ:

- MetaMask: A widely used Ethereum wallet that integrates seamlessly with Injective, offering ease of use for Ethereum-native users.

- Ledger: A hardware wallet that is known for its strong security and is ideal for securely storing INJ tokens.

- Keplr: A top choice for Cosmos users, Keplr offers excellent compatibility with Injective and other Cosmos-based chains.

- Cosmostation: Another Cosmos-compatible wallet, Cosmostation provides robust features for managing INJ and interacting with the network.

- Ninji Wallet: The only Injective-native wallet, specifically designed for optimal use within the ecosystem.

Conclusion

Injective Protocol stands out in the world of decentralized finance with its powerful, scalable platform designed for financial applications. The $INJ token plays a vital role in securing the network, facilitating governance, and serving as a medium of exchange. Whether you’re bridging assets, staking $INJ, or selecting a wallet, understanding these key aspects of Injective Protocol helps you maximize your engagement with this innovative ecosystem. With its strong market performance, advanced tokenomics, and wide range of supported wallets, Injective Protocol is well-positioned to continue leading the DeFi space.