Introduction: Bringing Wall Street to Web3

As the worlds of traditional finance (TradFi) and decentralized finance (DeFi) continue to converge, Ondo Finance has emerged as one of the most promising platforms leading this evolution. Built with a mission to tokenize real-world assets (RWAs) like U.S. Treasuries and institutional funds, Ondo is opening the floodgates for traditional capital to flow into crypto—securely, transparently, and at scale.

In this guide, we’ll explore what Ondo Finance is, its core features, the ONDO token, tokenized products like USDY and OUSG and upcoming projects like ONDO chain, recent high-profile partnerships, and how to buy ONDO using RocketX Exchange. Let’s dive into the future of tokenized finance.

What is Ondo Finance?

Ondo Finance is a decentralized finance (DeFi) platform that brings traditional financial products—like U.S. Treasuries and ETFs—onto the blockchain. Its goal is to make high-quality, stable investment options available to both everyday users and institutions, all while keeping things transparent, secure, and easy to access.

Founded in 2021 by Nathan Allman, a former Wall Street banker, Ondo was built to merge the strengths of traditional finance (TradFi) with the innovation of DeFi. That means offering safe, regulated investment options while also giving users 24/7 access, lower fees, and faster settlement through blockchain technology.

Here’s what makes Ondo special:

🔹 Tokenized Real-World Assets (RWAs): Ondo turns traditional assets like government bonds into tokens that can be traded on the blockchain.

🔹 Smart Risk Management: Earlier, Ondo used a “tranche” model, splitting investments into safer fixed-yield and higher-risk variable-yield tokens—giving users more control over their exposure.

🔹 Regulatory Compliance: Ondo makes sure it follows global regulations. For example, some assets are only available to non-U.S. users or accredited investors.

Why does this matter? Traditional financial systems are slow, expensive, and limited to specific hours. With Ondo, you get around-the-clock access to real financial products—on-chain, with lower costs and better efficiency.

In short, Ondo is building a new kind of finance: one that keeps the trust of the old system while offering the speed and freedom of the new.

Ondo Finance’s Real-World Asset Tokens: USDY & OUSG Explained

Ondo Finance is making it easier for people to access traditional financial assets—like U.S. Treasury bonds—on the blockchain. Its two main tokens, USDY and OUSG, let users earn real-world yield safely and easily, all through crypto wallets.

🔹 USDY (U.S. Dollar Yield)

USDY is a yield-bearing stablecoin backed by short-term U.S. Treasuries and bank deposits. It’s a great alternative to traditional stablecoins like USDT or USDC because it earns interest—around 5% annually. Over $590 million is already locked into USDY, showing strong demand. It’s available on major blockchains like Ethereum, Solana, and Sui, making it widely accessible. Due to regulations, only non-U.S. users can mint new USDY, but anyone can trade or swap it on exchanges or platforms like RocketX Exchange. USDY is fully backed (over 100%) by assets held with trusted custodians like Morgan Stanley and StoneX.

🔹 OUSG (Ondo U.S. Government Bond Fund)

OUSG gives users tokenized access to U.S. Treasury ETFs managed by top firms like BlackRock and WisdomTree. It offers a stable 4.1% yield and has more than $400 million in value locked. While only accredited investors can mint it directly, OUSG is useful in DeFi—for example, it can be used as collateral on platforms like Flux Finance.

Together, USDY and OUSG give crypto users a safe way to earn real yield backed by real U.S. government bonds—with 24/7 liquidity, blockchain transparency, and global access.

Ondo Chain: A Layer-1 Built for Real-World Assets (RWAs)

To fully unlock the potential of Real-World Asset tokenization, Ondo Finance is launching Ondo Chain, a purpose-built Layer-1 blockchain designed for institutional-grade financial infrastructure. Unlike general-purpose chains, Ondo Chain is optimized to support complex financial products like U.S. Treasuries, stocks, and ETFs—while maintaining regulatory compliance and institutional-grade security.

Why a Dedicated Chain?

Ondo identified several limitations with existing blockchains—like high gas fees, fragmented liquidity, and limited TradFi compatibility. Ondo Chain addresses these by offering:

- Omnichain Connectivity: It securely connects to Ethereum, Solana, XRPL, and more, serving as a central hub for tokenized assets without relying on risky third-party bridges.

- Stable Security: Validators on Ondo Chain stake yield-generating RWAs (like OUSG), rather than volatile crypto assets. This makes the network more stable and cost-efficient—especially during bear markets.

- Permissioned Validators: To meet compliance requirements, validators will be verified institutions. This inspires trust and enables seamless integration with TradFi systems, like bank settlement networks.

- Built-In Compliance: Ondo Chain will support jurisdictional rules, permissioned asset access, and real-time data feeds, ensuring that tokenized assets meet legal and regulatory standards.

The Future Hub for RWAs

Ondo Chain is expected to become the primary home for new Ondo products—like tokenized equities via its upcoming “Global Markets” platform. Over time, the $ONDO token may power governance, staking, and even transaction fees on this chain.

In short, Ondo Chain combines the transparency of DeFi with the control institutions require—paving the way for the global adoption of tokenized real-world finance.

The ONDO Token: Governance, Utility, and Tokenomics

$ONDO is the native utility and governance token of the Ondo Finance ecosystem. It empowers the community to shape the protocol’s future through decentralized governance, allowing holders to vote on proposals, upgrades, fee structures, and more. ONDO also plays a central role in governing related platforms like Flux Finance, aligning decision-making across Ondo’s ecosystem.

While ONDO is not required to use Ondo’s tokenized products like USDY and OUSG, it offers several benefits. These may include exclusive access to future offerings, governance participation on the upcoming Ondo Chain, and potential staking opportunities. Users can stake ONDO or provide liquidity to earn rewards, helping strengthen both the protocol and the token’s utility.

The token launched in early 2024 with a fixed supply of 10 billion ONDO—no inflation planned. Its distribution includes 52.1% allocated to ecosystem growth, 33% to development, and the remainder for early contributors and community incentives. The transparent, capped supply adds long-term sustainability to the token’s economic design.

For new users, think of ONDO as a governance pass to participate in the growth of tokenized real-world assets. You can easily buy ONDO tokens using RocketX Exchange—your secure, decentralized gateway to DeFi assets across 180+ chains.

How to Buy ONDO, USDY, and OUSG Using RocketX Exchange

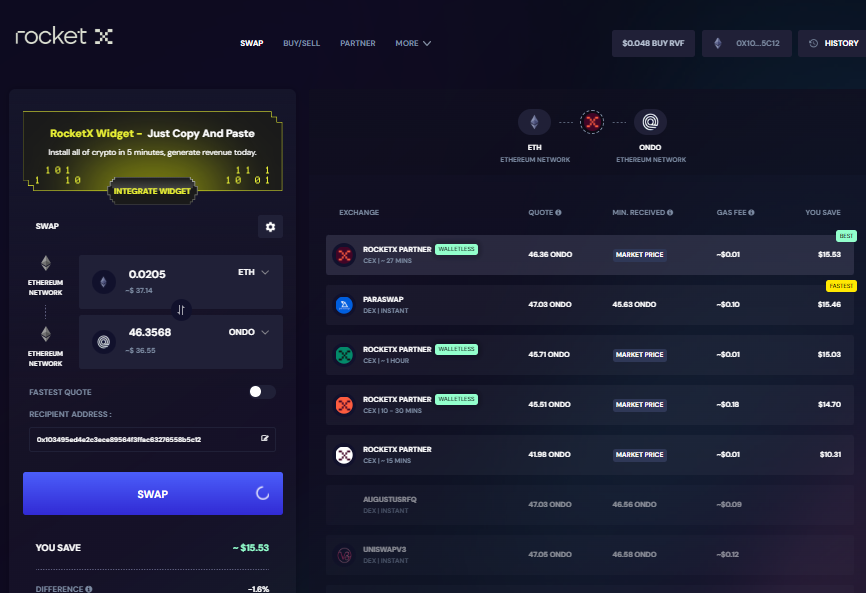

RocketX Exchange makes it incredibly easy to buy ONDO, USDY, and OUSG—no matter which network your funds are on. As a hybrid crypto aggregator, RocketX connects to 250+ exchanges and bridges across 180+ blockchains, giving you the best prices, minimal slippage, and a seamless experience. Whether you’re a DeFi native or just getting started, RocketX eliminates the complexity of cross-chain swaps and bridging.

Supported Tokens & Networks:

💡 Whether your funds are on Ethereum, BNB Chain, Solana, or Polygon, RocketX automatically handles the bridging and routing—saving you time and gas.

🔄 Step-by-Step Guide

- Visit RocketX Exchange

Go to rocketx exchange to begin. No sign-up or KYC is required—just connect your wallet and swap. - Connect Your Wallet

Click “Connect Wallet” and choose the wallet that matches your source network. Use MetaMask, Rabby, or WalletConnect for EVM-compatible chains like Ethereum, BNB Chain, Arbitrum, Polygon, etc. For Solana, use wallets like Phantom or Solflare. Similarly, select wallets accordingly based on the blockchains where your funds are stored. - Choose Tokens and Networks

In the swap interface:

- Select your source network and token (e.g., ETH or USDT on Ethereum, BSC, etc).

- Set Ethereum as the destination network and choose ONDO as the target token (since ONDO is an ERC-20 token).

- Enter Amount & Get the Best Quote

Type in the amount to swap. RocketX scans over 250 liquidity sources (DEXs, bridges, and aggregators) and shows the best real-time conversion rate, including all fees.

- Execute the Swap

Click “Swap,” approve the transaction in your wallet, and RocketX will do the rest.

For cross-chain swaps, Click on the “Cross-Chain swap” to confirm bridging approvals in your wallet. - Receive ONDO Tokens

Your $ONDO will appear in your wallet shortly. You can also track the transaction status in your RocketX history tab.

🔁 In this guide, we are buying ONDO using ETH on the Ethereum network. However, with RocketX, you can swap into ONDO, USDY, or OUSG from any supported chain or token—RocketX will take care of the bridging and routing behind the scenes.

Major Partnerships in the Last Six Months

Ondo Finance has rapidly strengthened its position in the Real-World Asset (RWA) sector through strategic partnerships with top-tier institutions in both crypto and traditional finance. These collaborations are not only enhancing Ondo’s credibility but also accelerating the adoption of its products across ecosystems.

Mastercard’s Multi-Token Network (MTN)

In February 2025, Ondo became the first RWA provider to join Mastercard’s Multi-Token Network. This integration allows Mastercard’s banking partners to hold Ondo’s OUSG tokens for 24/7 yield on idle cash. By connecting private payment rails to blockchain assets, this move positions OUSG as a potential treasury tool for banks and fintechs globally.

Ripple and the XRP Ledger

In January 2025, Ondo announced the deployment of OUSG on the XRP Ledger. Ripple and Ondo jointly seeded liquidity, enabling faster minting and redemption using Ripple’s stablecoin (RLUSD). This partnership introduces tokenized Treasuries to Ripple’s institutional clients, making XRP Ledger a powerful hub for RWA adoption.

World Liberty Financial (WLFI)

Ondo partnered with WLFI, a politically connected DeFi platform, to integrate USDY, OUSG, and tokenized stocks. WLFI even acquired 342,000 ONDO tokens, signaling deep commitment. The partnership brings Ondo’s yield-bearing products to a broader base of retail and institutional users.

Wellington Management

In late 2024, Wellington—a $1T+ asset manager—launched its on-chain Treasury fund with Ondo’s infrastructure. Investors can enter or exit anytime using Ondo’s liquidity layer. This collaboration signals trust from legacy finance giants in Ondo’s technology.

BlackRock & Securitize

Ondo also supports BlackRock’s $533M BUIDL fund and Securitize’s tokenization tools. While not a formal partnership, this ongoing integration with BlackRock-backed assets reflects Ondo’s credibility.

Expansion Across Chains: Sui & Cosmos (Noble)

Ondo launched USDY on Sui (with Mysten Labs) and brought tokenized Treasuries to Cosmos via Noble, expanding its multi-chain reach and enhancing asset interoperability.

Why These Partnerships Matter

These alliances validate Ondo’s RWA strategy, expand access to its products, and enhance ONDO token utility. By bridging institutional finance with blockchain networks like XRP, Cosmos, and Sui, Ondo is building a future-proof ecosystem at the intersection of DeFi and TradFi.

Future Potential and Trends for Ondo Finance

Ondo Finance is uniquely positioned at the intersection of traditional finance and DeFi, making it a frontrunner in the Real-World Asset (RWA) movement. One of its most ambitious upcoming initiatives is the Global Markets platform, designed to tokenize publicly traded securities like Apple and Tesla stocks, or ETFs. This could open up multi-trillion dollar equity markets to on-chain investors for the first time.

With the rollout of Ondo Chain, a purpose-built Layer-1 network optimized for institutional compliance and RWA scalability, Ondo could attract banks, asset issuers, and fintechs to deploy directly on-chain. Ondo Chain may also increase utility for the ONDO token, potentially using it for governance or gas fees.

As institutional DeFi adoption accelerates, Ondo’s early lead in tokenized Treasuries (USDY and OUSG) puts it ahead of the curve. The projected trillion-dollar growth of RWA markets could see even central banks or sovereign funds interacting with tokenized assets.

Additionally, Ondo may diversify into tokenized corporate bonds, international debt, or even real estate. Enhanced DeFi strategies like LaaS or RWA-backed vaults could provide new passive income opportunities.

With clear compliance, product flexibility, and innovation at its core, Ondo is well-positioned to shape the future of tokenized finance globally.

Final Thoughts

Ondo Finance isn’t just a DeFi project—it’s a financial movement. By tokenizing real-world assets and providing institutional-grade products on-chain, it’s redefining how we invest, earn, and interact with the global economy.

With products like USDY, strong partnerships across TradFi and Web3, and an ever-expanding ecosystem powered by ONDO token, the platform is primed to become the go-to gateway for secure, transparent, and yield-generating tokenized assets.

For users looking to diversify into RWAs or explore tokenized Treasuries, RocketX Exchange makes it easier than ever to access ONDO across multiple chains, in just a few clicks.