Introduction

The cryptocurrency world thrives on innovation, and blockchain projects continuously push the boundaries to solve challenges related to scalability, security, and decentralization. One project that has gained significant traction is EigenLayer, a protocol offering a unique solution by leveraging restaking to improve security across multiple networks. With its distinctive approach and the attention garnered by the EIGEN token, EigenLayer is positioning itself as a critical player in the decentralized finance (DeFi) space. This guide dives deep into how EigenLayer works, the potential of the EIGEN token, the details of its airdrop, and how to engage with the project using RocketX Exchange.

What is EigenLayer?

EigenLayer stands out among blockchain protocols by introducing the concept of restaking, allowing users to maximize their staked assets’ utility. Built on Ethereum, the platform enables users to restake assets—such as Ethereum (ETH) or Liquid Staking Tokens (LSTs)—to secure multiple blockchain networks simultaneously.

Traditional staking involves locking up tokens to secure just one network, but EigenLayer takes this further by providing a multi-layered security approach. The protocol empowers projects to tap into Ethereum’s security, reducing costs and complexity while still benefiting from decentralized security models.

But what exactly is restaking? It’s the ability to take staked assets and apply them to multiple networks, essentially “recycling” their security power. This not only strengthens smaller blockchains that cannot afford to create robust security infrastructures on their own, but it also provides extra rewards for participants by allowing them to secure multiple networks using the same staked tokens.

How EigenLayer Works?

At its core, EigenLayer’s restaking protocol is designed to improve both security and scalability for decentralized applications (dApps) and smaller blockchain networks. Here’s how it works in practice:

- Restaking ETH and LSTs: Users who have already staked their ETH or LSTs can restake these assets on EigenLayer, securing various blockchain networks. These staked assets power the Active Validator Sets (AVS), enabling validators to support multiple protocols simultaneously.

- Enhanced Security for dApps and Networks: EigenLayer allows smaller projects to leverage Ethereum’s established security, reducing the need for new projects to build their own independent security infrastructure. This shared security model improves the overall resilience of the decentralized ecosystem.

- Rewards for Validators and Stakers: Validators who participate in securing multiple networks earn additional rewards from EigenLayer. By supporting multiple actively validated services (AVS), participants maximize their earnings while contributing to the platform’s growth and security.

EigenLayer’s ability to provide security across several networks without increasing complexity or costs makes it an attractive option for both developers and investors.

Everything You Need to Know About the EIGEN Token:

The EIGEN token is the native cryptocurrency of EigenLayer, playing an integral role in the platform’s ecosystem. Here’s a closer look at its tokenomics, use cases, and the potential it holds.

Tokenomics: Summary of EIGEN Token Supply

The EIGEN token has a capped supply of 1.67 billion tokens, distributed as follows:

- 45% Community:

- 15% for stakedrops (e.g., Season 1 had 113 million tokens distributed).

- 15% for community initiatives, incentives, and inflation.

- 15% for R&D, ecosystem growth, and operational costs.

- 29.5% Investors: Allocated to early investors.

- 25.5% Early Contributors: Reserved for developers and key participants.

Inflation: EIGEN has a 4% annual inflation rate to reward stakers and validators. After a 1-year lock-up, contributor tokens unlock at 4% monthly.

This distribution ensures the gradual release of tokens, fostering long-term project stability and community engagement.

Use Cases

The EIGEN token is designed to have several important use cases within the EigenLayer ecosystem:

- Governance: EIGEN holders can participate in the platform’s governance by voting on critical decisions, such as protocol upgrades, changes, and new project developments.

- Staking: Stakers can lock up their EIGEN tokens to secure EigenLayer, ensuring its smooth functioning and receiving rewards in return.

- Incentive Mechanism: The token serves as an incentive for validators, encouraging them to restake assets and contribute to securing multiple blockchain networks through the AVS feature.

- Security: As EigenLayer expands, the token plays a crucial role in ensuring that smaller and newer networks can leverage shared security resources.

Future Potential

The growing interest in decentralized security models bodes well for EigenLayer’s future. As more projects look to tap into Ethereum’s security, the demand for restaking services is expected to rise, driving up the utility and value of the EIGEN token. The restaking model could become a game-changer for decentralized networks struggling to afford their own security models, positioning EigenLayer as a critical player in the blockchain space.

EigenLayer Airdrop: Distribution and Eligibility Overview

The EigenLayer airdrop was one of the most highly anticipated events in the platform’s journey, distributing a significant amount of tokens to early supporters and validators. Below are the key details:

Distribution Overview

- Season 1 Allocation: A total of 113 million EIGEN tokens were distributed to users during Season 1. This represented 6.75% of the total initial supply.

- Snapshot Date: The snapshot determining eligibility was taken on March 15, 2024, at block #19437000.

- Bonus EIGEN Tokens: In addition to regular rewards, all participants in Season 1 received an additional 100 EIGEN tokens as a bonus, in appreciation of early support.

Eligibility Criteria

To qualify for the Season 1 airdrop, users need to have interacted with the EigenLayer platform or related services before the snapshot date. Eligible participants included:

- ETH and LST Restakers: Users who restaked ETH or LSTs directly on the platform.

- Liquid Restaking Token (LRT) Users: Users of LRTs, who are eligible for both phases of Season 1 distribution.

Moving forward, 15% of the total EIGEN supply has been set aside for further stake drops, providing more opportunities for the community to earn tokens through active participation.

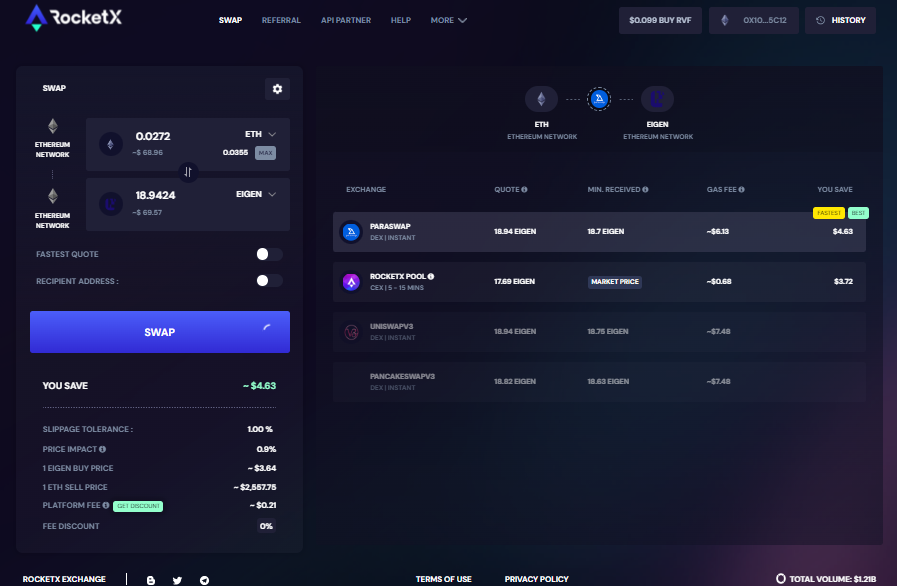

How to Buy, Sell, or Trade EIGEN Tokens Using RocketX Exchange

RocketX Exchange makes buying, selling, or trading EIGEN tokens simple, thanks to its intuitive interface and wallet integration. Here’s a quick guide:

Step 1: Connect Your Wallet

Head to RocketX Exchange and select “Connect Wallet”. You can link a Web3 wallet like MetaMask, Trust Wallet, or Coinbase. No need to create an account; just connect your wallet and you’re ready to trade.

Step 2: Select Networks and Tokens

Choose the network and token you wish to trade. For example, if you’re swapping ETH to EIGEN, select Ethereum as the source network and EIGEN as the destination asset. If you’re swapping EIGEN for another token, just select the network and token of your choice. RocketX Exchange allows you to cross-swap EIGEN with a wide variety of tokens seamlessly, giving you the flexibility to trade across different chains and assets. In this guide, we are buying EIGEN tokens using ethereum.

Step 3: Enter Transaction Details

Specify the amount of cryptocurrency to exchange. Make sure to account for transaction fees in your balance.

- Enter Amount: Specify the amount to transfer.

- Confirm the Swap: Review your transaction and confirm the swap. RocketX will securely handle the transaction for you

- Receive Your Tokens: Once the swap is complete, your newly purchased tokens will be transferred to your wallet.

-

Note: Always remember that meme coins can be volatile, and while they offer exciting opportunities, they also come with risks. Make sure to do thorough research and consider consulting with a financial advisor before investing.

Conclusion

EigenLayer’s restaking protocol is a breakthrough in decentralized security, providing blockchain networks with enhanced security through Ethereum’s shared resources. The EIGEN token, through its governance and staking use cases, offers a solid incentive for users to participate in the platform’s growth. With the successful completion of the airdrop and the availability of RocketX Exchange for trading EIGEN tokens, the platform is poised for continued success.

As the demand for decentralized security solutions grows, EigenLayer has positioned itself as a leader in the field, offering a unique and powerful solution for blockchain networks of all sizes. For those looking to engage with this exciting project, whether by participating in future stake drops or trading EIGEN tokens, EigenLayer presents a valuable opportunity to be part of the next wave of blockchain innovation.